-

-

Dubai, UAE/Amsterdam, Netherlands

-

Amsterdam Exhibition

-

OutSystems

OutSystems is an enterprise AI application development platform that helps organizations rapidly build custom apps and intelligent agents for mission-critical operations. It enables companies to modernize legacy systems by extending core data and processes through agentic solutions, while managing the full lifecycle of applications and AI agents in a single unified environment.Combining low-code development with generative AI, OutSystems allows teams to deliver software up to 10× faster, adapt quickly to changing business needs, and reduce technical debt. Founded in 2001, the platform serves customers across 80 countries and 21 industries, supported by a global ecosystem of over 900,000 community members and 600+ partners.

-

Akkuro

Akkuro is a next-generation composable banking platform designed to help financial institutions innovate faster, integrate seamlessly, and scale with confidence. Its modular architecture enables banks and fintechs to combine best-in-class capabilities across lending, payments, deposits, investments, and more—without disrupting existing systems. By allowing organizations to adapt in real time, launch new services quickly, and evolve their infrastructure as needs change, Akkuro empowers them to stay competitive in a rapidly transforming financial landscape. Built for agility and engineered for scalability, Akkuro delivers the flexibility modern finance demands and the resilience institutions need for the future.

-

BlueMonks

BlueMonks is a specialized service provider focused on AML (Anti-Money Laundering), KYC (Know Your Customer), and sanctions compliance. With a strong emphasis on innovation, BlueMonks delivers full managed KYC services, including multilingual service desk support and AI-driven KYC processes. The company is actively involved in developing next-generation KYC tooling and solutions, bridging technology and compliance to help organizations mitigate financial crime risks effectively.

Exhibitor

Information for Exhibitors

Marketplace For Solutions & Innovations

Opportunities for professionals and industries

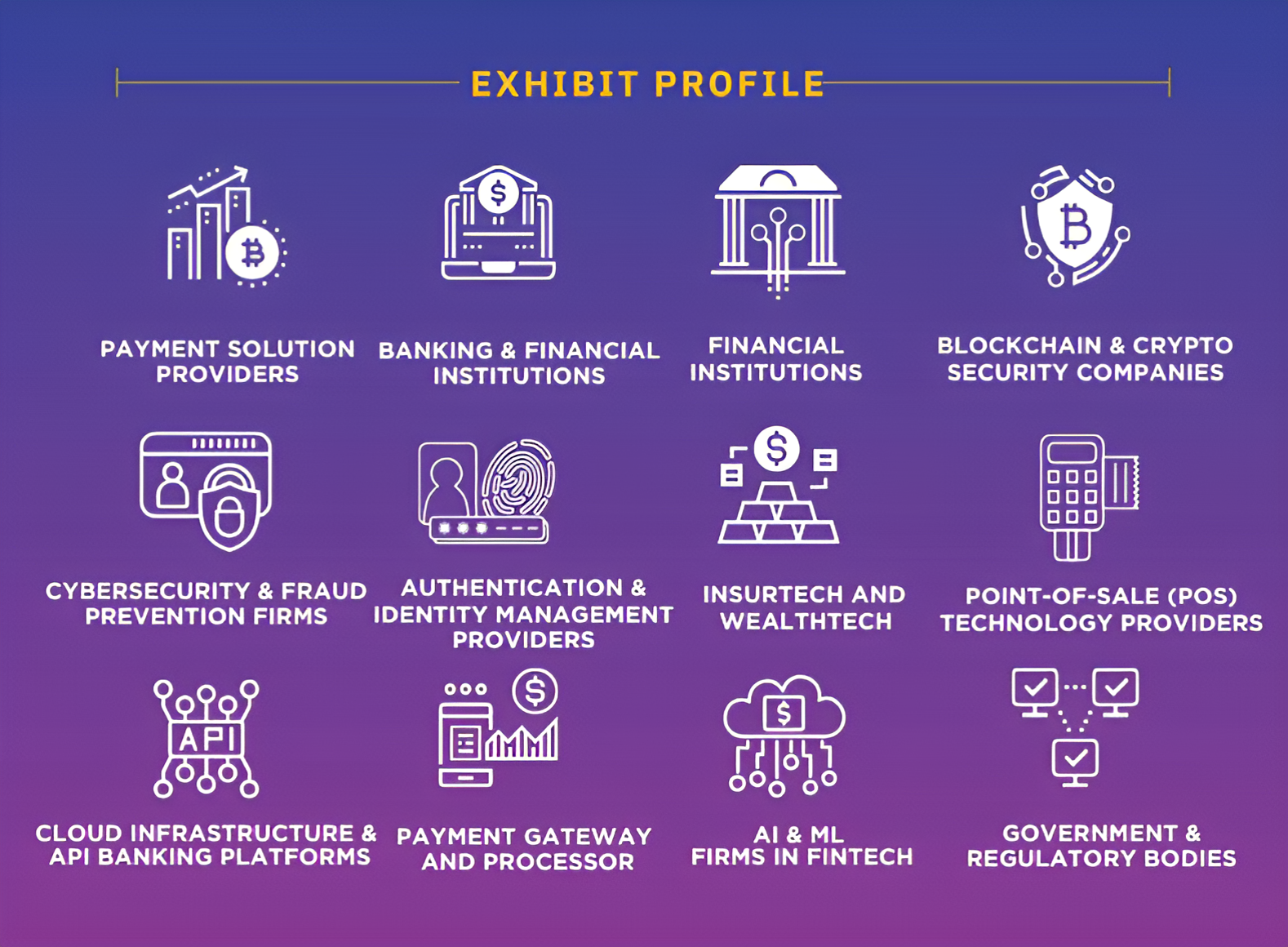

3rd Fintech Week & Expo Amsterdam 2026 provides a perfect platform for you to showcase your products and services to an engaged audience actively seeking new business opportunities and partnerships. It also facilitates domestic Fintechs in their journey to collaborate with companies from across the globe. The event showcases companies and institutions involved in financial technologies, encompassing blockchain, cryptocurrency, digital banking, e-wallets, payment gateways, Point of Sale (PoS) & payment solutions, cybersecurity, banking & insurance solutions, accounting & auditing solutions, e-commerce solutions, robotic process automation (RPA), transactional platforms, data analytics, and more.

With a clear focus on embedded finance, customer experience, and benchmarking global fintech strategies, Europe and North Africa’s unrivaled meeting place for global fintech leaders will showcase the financial industry’s biggest tech revolutions in the fields of paytech, insurtech, regtech, wealth & asset management, and digital banking presented by 100+ globally leading financial services companies and most disruptive startups. Over 80 path-breaking talks by global regulators, financial institutions, and unicorns will redefine fintech strategies in the region. Targeted 100+ startup meetings with tech buyers and investors will drive immediate business impact. With fintech adoption rates in the Middle East growing year on year, adopting the right strategies and solutions to increase client satisfaction is crucial. Do not miss out on being part of a movement happening at Fintech Surge, the premier hub for Fintech entrepreneurs, buyers, innovators, investors, and regulators.

Exhibition Booth

Table Top 3X3 m space

-

3 passes (1 speaking slot)

-

Receive booth dimensions: 3x3 meters

-

1 no. rollup standee

-

Access to attendee lists and lead retrieval

-

1 no. of wastepaper basket

Contact- kimcy@eufintechweek.com

Shell Scheme 3X3 m

-

3 passes (1 speaking slot)

-

Receive booth dimensions: 3x3 meters

-

Receive one table and two folding chairs

-

Access to attendee lists and lead retrieval

-

One fascia board and power point with cord

-

1 no. of wastepaper basket

Contact- kimcy@eufintechweek.com

3rd Fintech Week & Expo Amsterdam 2026 event can be particularly valuable, providing an opportunity to connect with potential investors and partners. Overall, Fintech Week is a valuable opportunity for anyone interested in the financial technology sector to learn about new technologies, connect with industry professionals, and gain insights into the future of finance. Whether you’re a startup founder, an investor, or simply curious about the latest fintech innovations, attending an event is an experience you won’t want to miss.

Are you interested in exhibiting at 3rd Fintech Week & Expo Amsterdam 2026 ? then kindly contact – douminlian_t@fintechweek.uk to book your exhibition space today!